In 2019, RBC acquired an accounts payable automation fintech company called WayPay. Eventually rebranded as RBC PayEdge, the vision for the platform would serve two purposes:

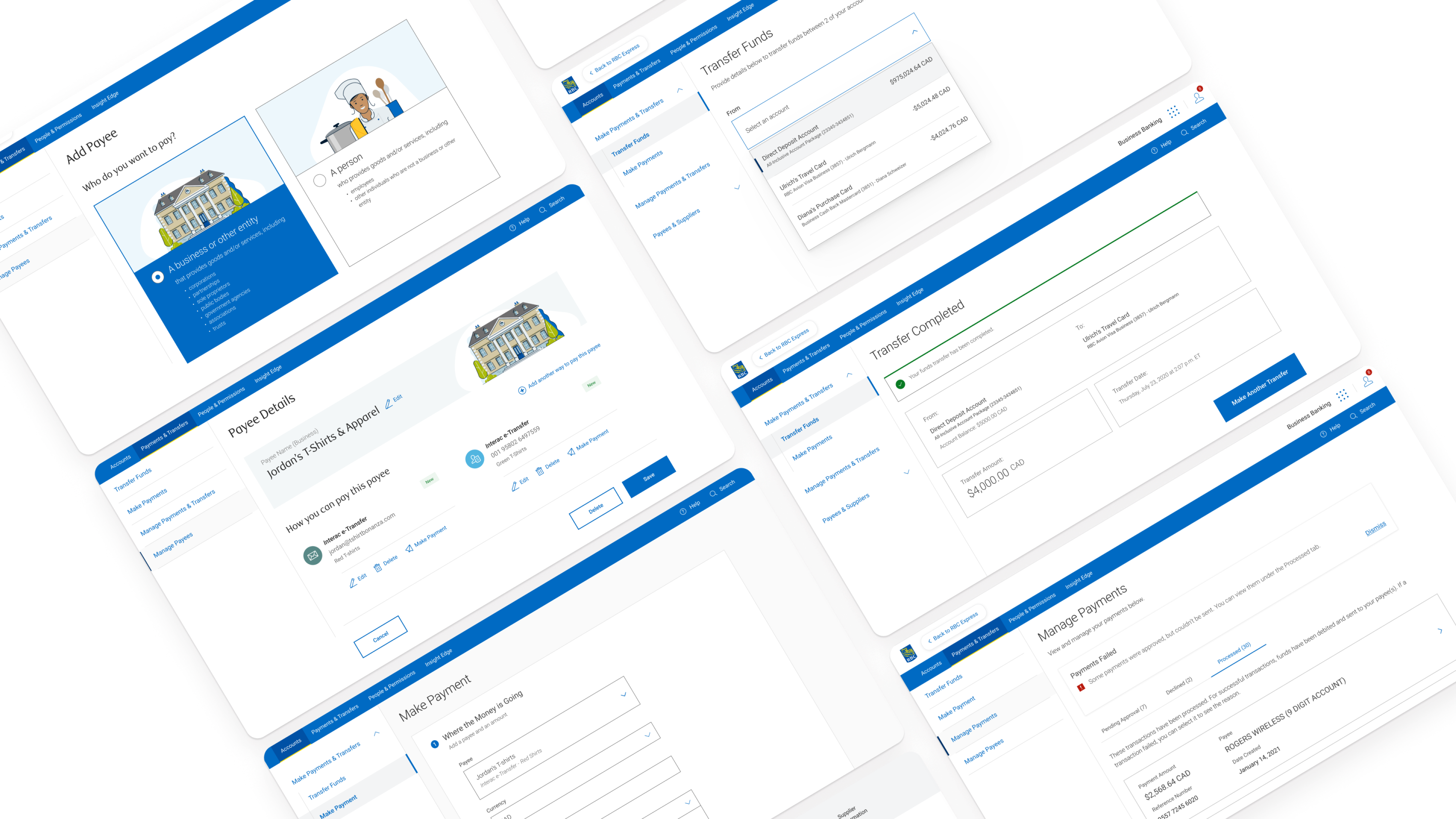

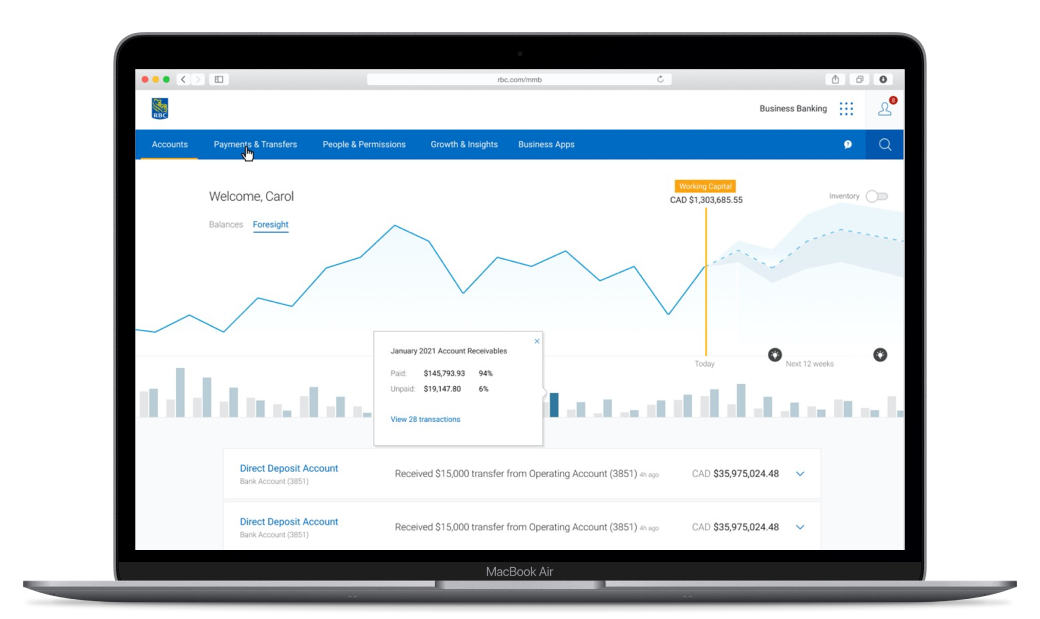

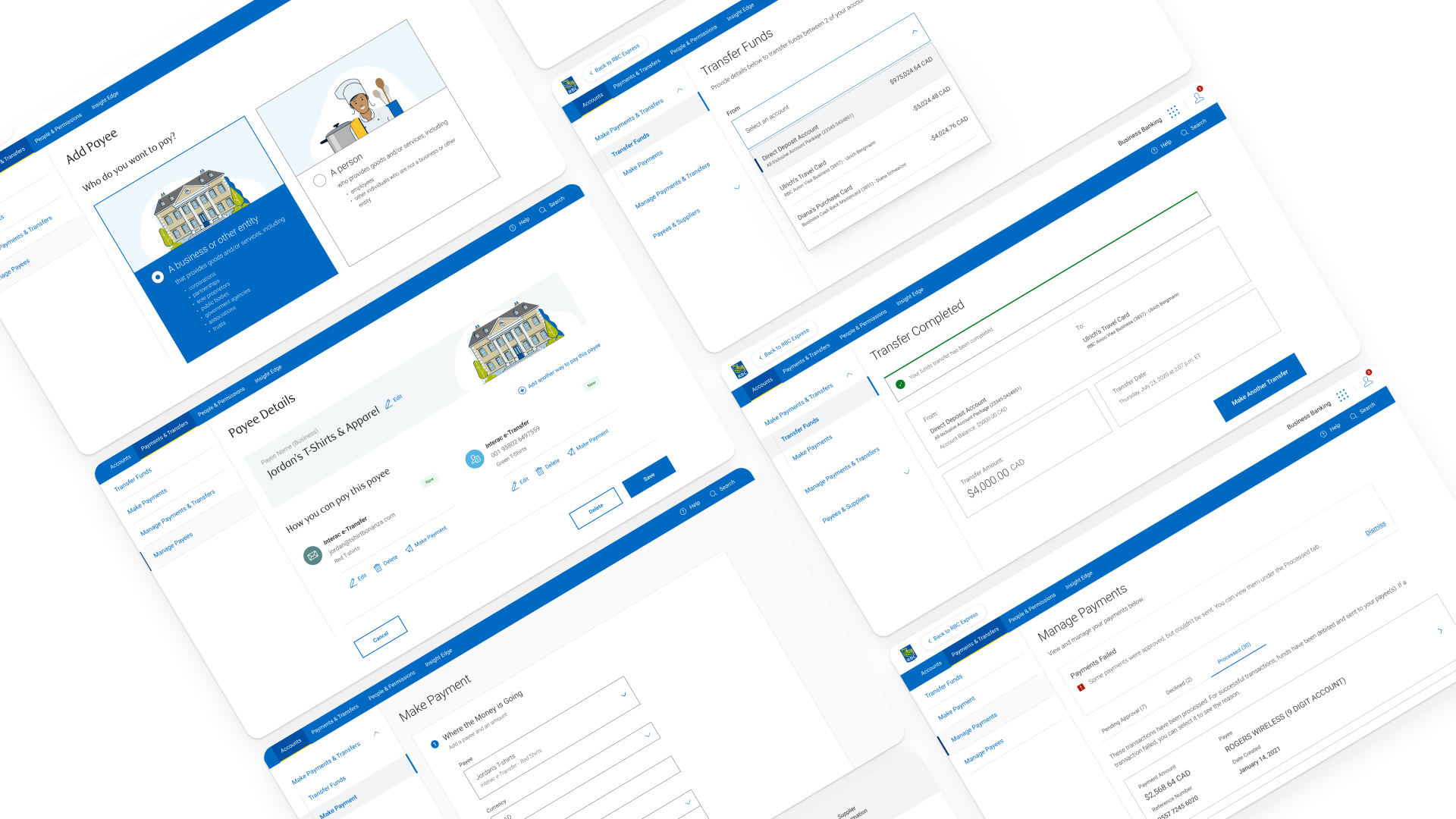

- Leveraging the proprietary payments engine as a building block for a new generation of business banking.

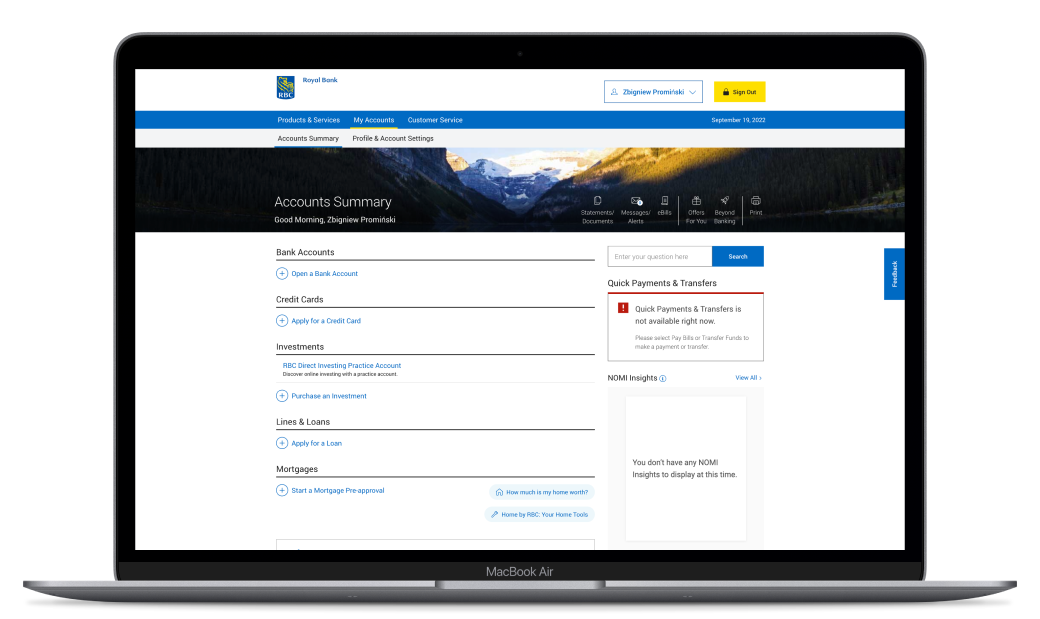

- Value-added selling to existing customers.

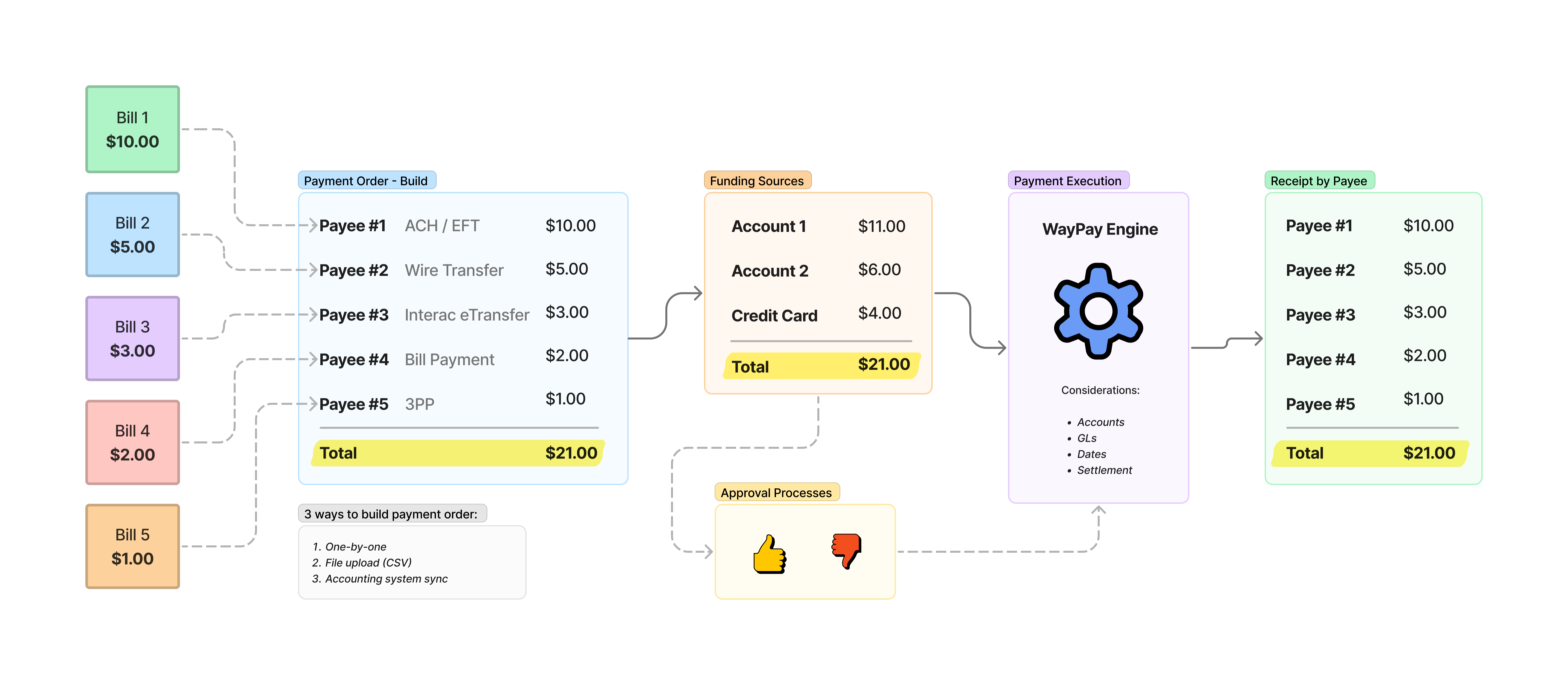

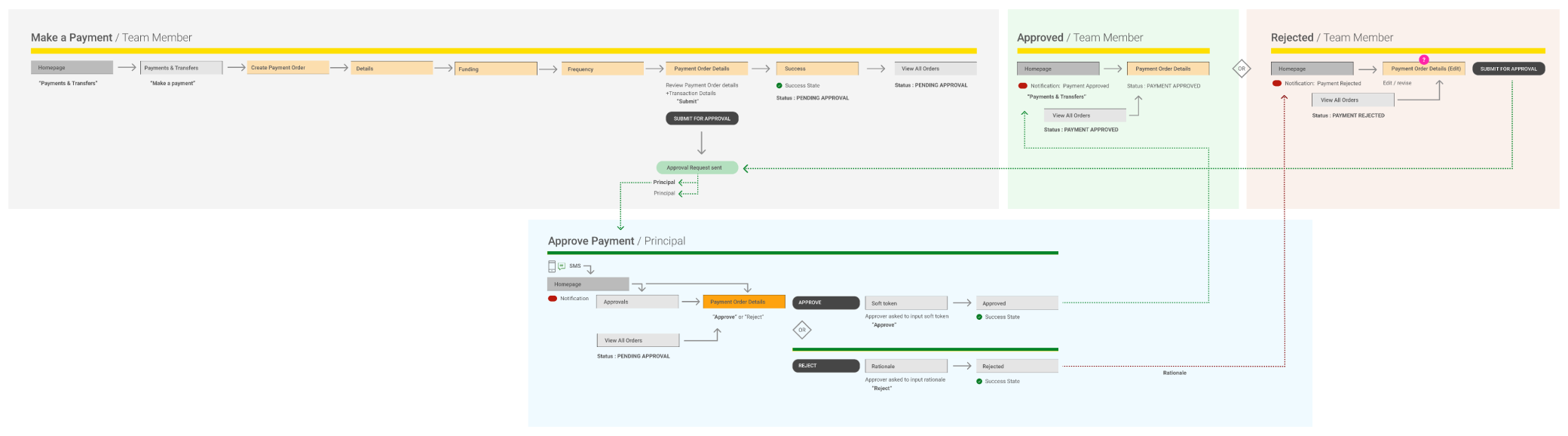

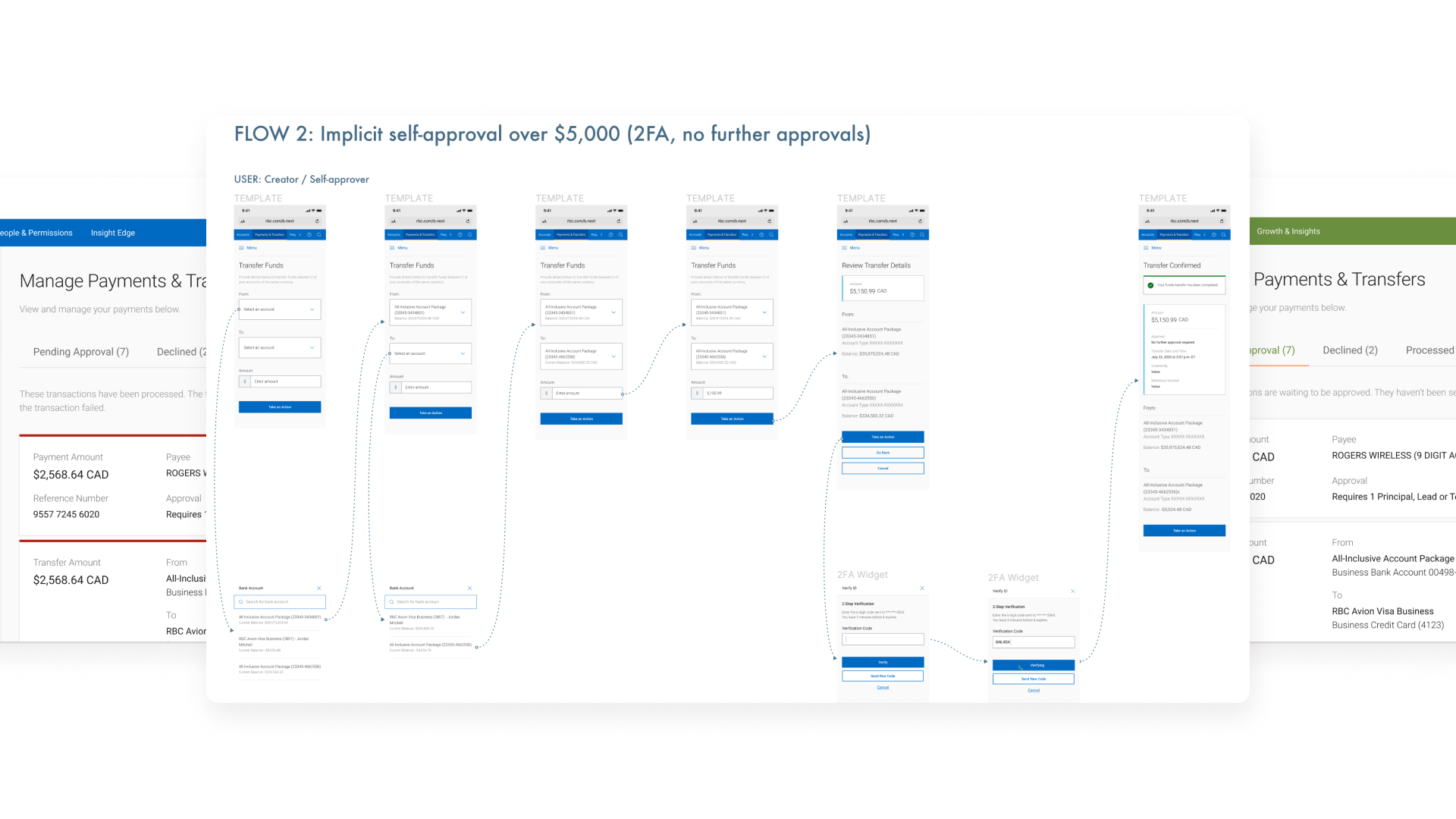

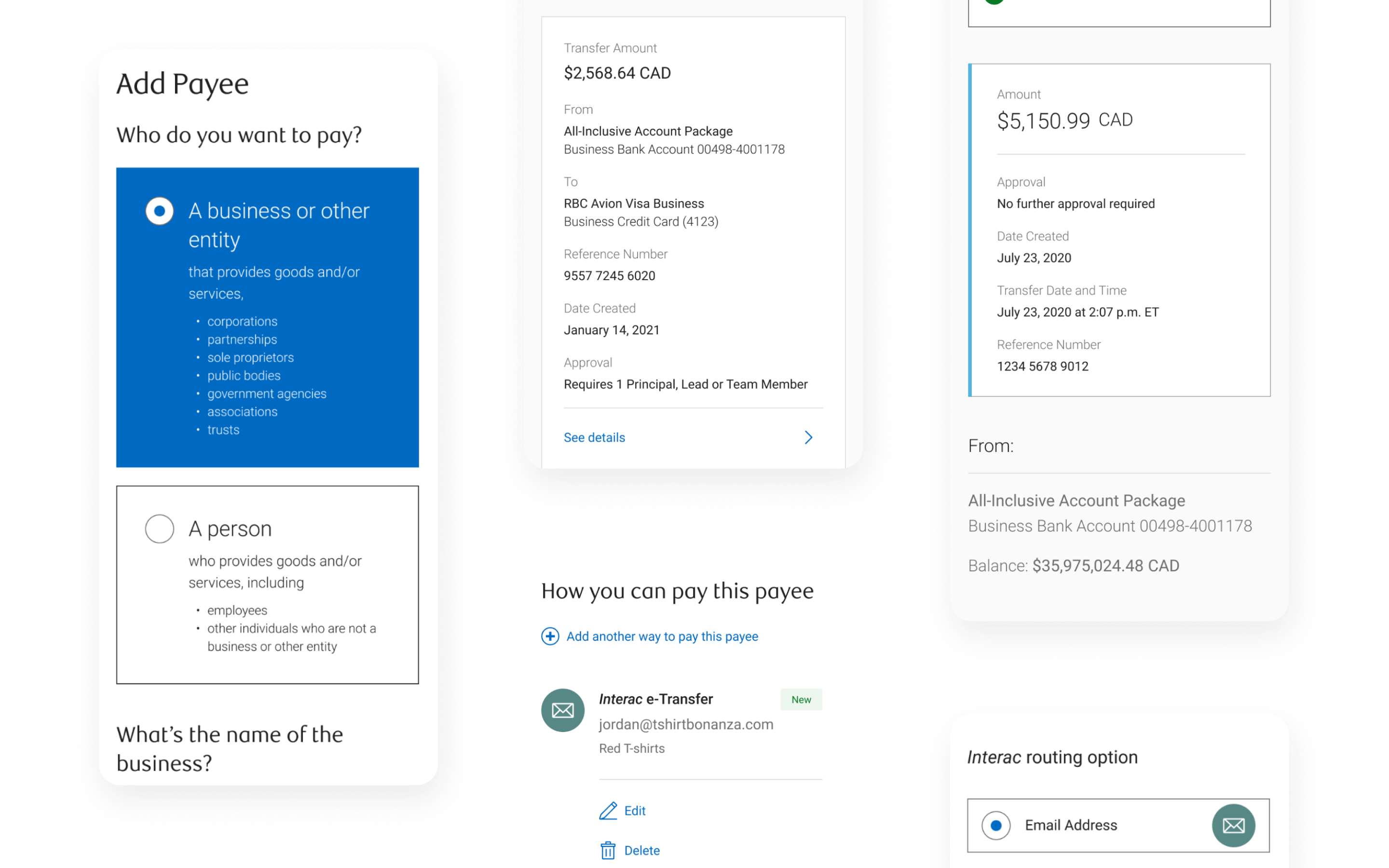

A payment order is a way to create a payment request that combines different disbursement types and different funding sources. A practical example would be an e-commerce shopping cart, where a client collects items and pays for them.

The difference in the case of a payment order is instead of purchasing goods, the client builds their “cart” with outgoing payments. Once collected, the order can be funded from multiple sources such as bank accounts, credit cards, etc.

As part of my regular role, I was frequently called upon to simplify and promote the benefits of the payment order concept.